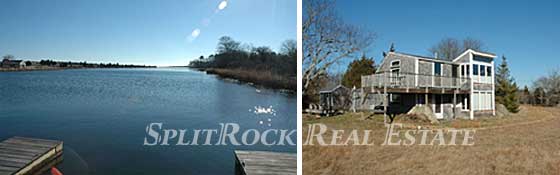

| West Tisbury Unique Location ~ $850,000 |

|

| This property is within walking distance to Alley’s General Store as well as the Tisbury Great Pond. If that sounds good for starters, I can tell you more. Inquire with Peter. |

Martha's Vineyard Exclusive Buyer Agent Real Estate News and Views including market conditions, vacation home and luxury property information concerning Edgartown, Oak Bluffs, Vineyard Haven, West Tisbury, Chilmark and Aquinnah. If it's on my mind, I'll discuss it.

Wednesday, December 21, 2005

Peter's Pick - December 21, 2005

Martha's Vineyard Real Estate Pick of the Week

Friday, December 16, 2005

Martha's Vineyard Real Estate Value of the Week - December 16, 2005

Peter's Pick of the Week: EDGARTOWN ~ $2,350,000

I am usually not impressed with the new spec houses that have been going up in Edgartown. However, this 3,600sf 4-bedroom, +4-bath house wowed me. Contact me via my web site SplitRockRE.com or by calling me 508-696-9009. I'd be happy to talk with you about this Martha's Vineyard investment value.

- Peter Fyler

I am usually not impressed with the new spec houses that have been going up in Edgartown. However, this 3,600sf 4-bedroom, +4-bath house wowed me. Contact me via my web site SplitRockRE.com or by calling me 508-696-9009. I'd be happy to talk with you about this Martha's Vineyard investment value.

- Peter Fyler

Tuesday, December 13, 2005

Negative Amortization Loans

(By Peter C. Fyler, Martha's Vineyard Buyer Broker on the web at SplitRockRE.com)

As 2005 draws to a close, Comptroller of the Currency John C. Dugan has singled out negative amortization loans (NAL’s) as a primary concern of the Treasury Department; they may not be as readily available in 2006.

Negative Amortization loans are also known as payment-option loans, and therein lies the problem. In order to afford the loan the mortgagor will need to make reduced payments. The amount of the loan subsequently increases due to a build-up in principle and interest caused by the low monthly payments. Theoretically, what protects the mortgagor is the assumption that a property purchased today will appreciate significantly within the life of the loan, say 5 years, and the loan will not out pace the value of the property. At the end of the term the payment plan adjusts and if the mortgagor cannot refinance the mortgage, the “payment shock” could be devastating as the loan payment amount could potentially double.

Why was this product created? One reason is to allow people to purchase properties in high-cost areas, like Martha’s Vineyard or California where they would need to assume huge mortgages. Although there is very little one can invest in that will realize a better return than real estate because of the low interest rates and high property appreciation percentages, negative amortization loans can still be a trap even for the more sophisticated borrower. Who are the best candidates for negative amortization loans? Borrowers with impeccable credit backgrounds and solid incomes who are able to make a substantial downpayment are subject to the least risk.

On Martha’s Vineyard we have experienced a very healthy run during the last 5 years and some say we have hit the wall. Prices have consistently increased, although not at the hysterical rate they did during the 1980’s. I still believe our market is alive and well and real estate appreciation will remain steady despite a slight adjustment in the current market. The Vineyard is one of those special and unique destinations that remain widely popular both nationally and internationally. Given the right property in the right location at the right price, the chances are pretty good that your investment will remain safe despite bumps in the economic road.

For more information on buying or investing in Martha's Vineyard Real Estate, please visit our informative web site at SplitRockRE.com.

As 2005 draws to a close, Comptroller of the Currency John C. Dugan has singled out negative amortization loans (NAL’s) as a primary concern of the Treasury Department; they may not be as readily available in 2006.

Negative Amortization loans are also known as payment-option loans, and therein lies the problem. In order to afford the loan the mortgagor will need to make reduced payments. The amount of the loan subsequently increases due to a build-up in principle and interest caused by the low monthly payments. Theoretically, what protects the mortgagor is the assumption that a property purchased today will appreciate significantly within the life of the loan, say 5 years, and the loan will not out pace the value of the property. At the end of the term the payment plan adjusts and if the mortgagor cannot refinance the mortgage, the “payment shock” could be devastating as the loan payment amount could potentially double.

Why was this product created? One reason is to allow people to purchase properties in high-cost areas, like Martha’s Vineyard or California where they would need to assume huge mortgages. Although there is very little one can invest in that will realize a better return than real estate because of the low interest rates and high property appreciation percentages, negative amortization loans can still be a trap even for the more sophisticated borrower. Who are the best candidates for negative amortization loans? Borrowers with impeccable credit backgrounds and solid incomes who are able to make a substantial downpayment are subject to the least risk.

On Martha’s Vineyard we have experienced a very healthy run during the last 5 years and some say we have hit the wall. Prices have consistently increased, although not at the hysterical rate they did during the 1980’s. I still believe our market is alive and well and real estate appreciation will remain steady despite a slight adjustment in the current market. The Vineyard is one of those special and unique destinations that remain widely popular both nationally and internationally. Given the right property in the right location at the right price, the chances are pretty good that your investment will remain safe despite bumps in the economic road.

For more information on buying or investing in Martha's Vineyard Real Estate, please visit our informative web site at SplitRockRE.com.

Monday, December 12, 2005

Martha's Vineyard experiences a "Wintercane"

Yesterday mother nature bestowed upon this little Island the worst weather that I have seen in years. Early in the day, the forecast was panning out as predicted with steady mild to torrential rains soaking the Island. Then a little after mid-day, the sun blazed through the clouds and everything was calm and bright for about 30 minutes. But the mood quickly changed as huge flakes of snow began to fall and the wind really started to amp up. Snow squalls increased and finally it wasn’t snowing vertically, it was all horizontal. I estimated the wind velocity to be about 60-70 mph with gusts well above that. Later I learned that gusts were clocked at over 90 mph and average winds were 73 mph, which is still not considered hurricane strength. The power started to flicker and I finally shut my computers down as businesses all over were throwing in the towel sending their employees out to wind their way home through what was becoming an increasingly treacherous obstacle course. At about 3PM the flicker turned into a permanent outage and we were in the dark until about 10PM. It has been estimated that about 150,000 NStar customers were without electric service yesterday and 25,000 are still without service today. Huge trees fell all over the Vineyard taking with them vital power and communications lines --- it was a mess. The weather people are calling this phenomenon created by the convergence of two fronts a Wintercane. Today we are back to a typically beautiful day and there is no snow on the ground, just tree limbs.

There are constant weather links on our web site, SplitRockRE.com

There are constant weather links on our web site, SplitRockRE.com

The special Holiday Spirit of Martha's Vineyard

Today is December 7th and 64 years ago 2,300 Americans died in the blink of an eye. Have you ever been to Hawaii? To the Pearl Harbor Memorial? Don’t miss it, it will make you cry.

My wife and I were walking along the streets of downtown Edgartown the other night after appreciating an electrifying experience at a standing room only concert gifted by the Island Community Chorus at the Old Whaling Church. We were admiring the serenely tasteful saturation of twinkling lights and evergreen wreathes presenting from the stately and classic bleached white houses. What came to my mind was that I have not lived in or been to a place like this where an entire community --- an entire Island community gets together to celebrate the holidays the way people on Martha’s Vineyard do. I imagined myself hovering in space that night high above the Island watching the exodus of lights from the epicenter on Main Street as people wound their way back to their nests in all six towns of this tiny Island. If you love the Vineyard you have got to come here during the off-season but I warn you, pack your inner resources and leave your aggressions at home.

Best Holiday wishes from SplitRock Real Estate!

My wife and I were walking along the streets of downtown Edgartown the other night after appreciating an electrifying experience at a standing room only concert gifted by the Island Community Chorus at the Old Whaling Church. We were admiring the serenely tasteful saturation of twinkling lights and evergreen wreathes presenting from the stately and classic bleached white houses. What came to my mind was that I have not lived in or been to a place like this where an entire community --- an entire Island community gets together to celebrate the holidays the way people on Martha’s Vineyard do. I imagined myself hovering in space that night high above the Island watching the exodus of lights from the epicenter on Main Street as people wound their way back to their nests in all six towns of this tiny Island. If you love the Vineyard you have got to come here during the off-season but I warn you, pack your inner resources and leave your aggressions at home.

Best Holiday wishes from SplitRock Real Estate!

Friday, October 07, 2005

Bubble? Froth? Fermenting opportunities for the Buyer!

by Peter Fyler, October 7, 2005

I've been saying all along that I do not believe we are in a “bubble”, and it is Fed Chairman Alan Greenspan who is now coining a new word to describe activity in the housing market --- “frothy”. I was reading an interesting article the other day about the national real estate market. I wanted to share some of it with you here.

A survey by RBC Capital Markets, an international corporate

and investment bank, determined that nearly 60% of U.S. homeowners are confident that the value of their homes will increase

at least 5% annually during the next seven years. They have little concern for a so-called housing bubble. However, as we are seeing in the New England area, there is a slowing down of real estate gains as well as falling housing prices, ultimately affecting people’s spending habits.

NAR (National Association of Realtors©) stats show the index

in the West rose 7.6 percent to 136.7 in August and was 8.7 percent higher than August 2004. The index in the Midwest increased 2.8 percent to a level of 119.4, and was 0.5 above

a year ago. In the South, the index rose 2.2 percent to 142.1, and was 7.6 percent higher than August 2004. The Northeast index declined 0.5 percent to 108.5 in August, and was 2.2 percent lower than a year ago.

Greenspan recently said, over the past decade the market value of owner-occupied homes consistently rose at an average annual rate of about 9%. Home mortgage debt associated to these homes rose at an even higher rate. I think the real concern; according to Jim Kennedy of the Federal Reserve Board is that discretionary borrowing of home equity accounts for about four-fifths of the rise in home mortgage debt. The gap has narrowed in terms of loan to value ratio and that is of critical concern should mortgage rates go up. The unprecedented low level of mortgage interest rates has been the driving force behind this discretionary borrowing caused by a confidence in the dramatic rise in home prices in many areas of the country. The low interest rates have also fueled the increase in new housing starts as well as the increased turnover rate in existing homes.

I though it was interesting to note that they are saying a substantial part of the increased turnover rate is due to purchases in the second home market. The majority of these purchases being for vacation or investment purposes. Home Mortgage Disclosure Act (HMDA) statistics show that mortgage originations for second-home purchases increased from 7 percent of total purchase originations in 2000 to twice that at the end of 2004. It is suggested that second home purchases are more speculative in nature and not limited by concerns of owner relocation. More of these homes are paid for wholly in cash. It is believed that the number of second home and investment sales is at unprecedented levels and that is what is contributing to the rise in home prices.

What does all this mean? Who knows, but to me it means --- you as a buyer may have an opportunity at this moment resulting from the perceived slowdown in speculative purchases and seller’s fear that we are at the top of the market and they are not going to realize their anticipated gains.

This article is the express opinion of Peter C. Fyler and may not be reprinted or used without his permission.

by Peter Fyler, October 7, 2005

"That's right, I said it: Frothy!" |

A survey by RBC Capital Markets, an international corporate

and investment bank, determined that nearly 60% of U.S. homeowners are confident that the value of their homes will increase

at least 5% annually during the next seven years. They have little concern for a so-called housing bubble. However, as we are seeing in the New England area, there is a slowing down of real estate gains as well as falling housing prices, ultimately affecting people’s spending habits.

NAR (National Association of Realtors©) stats show the index

in the West rose 7.6 percent to 136.7 in August and was 8.7 percent higher than August 2004. The index in the Midwest increased 2.8 percent to a level of 119.4, and was 0.5 above

a year ago. In the South, the index rose 2.2 percent to 142.1, and was 7.6 percent higher than August 2004. The Northeast index declined 0.5 percent to 108.5 in August, and was 2.2 percent lower than a year ago.

Greenspan recently said, over the past decade the market value of owner-occupied homes consistently rose at an average annual rate of about 9%. Home mortgage debt associated to these homes rose at an even higher rate. I think the real concern; according to Jim Kennedy of the Federal Reserve Board is that discretionary borrowing of home equity accounts for about four-fifths of the rise in home mortgage debt. The gap has narrowed in terms of loan to value ratio and that is of critical concern should mortgage rates go up. The unprecedented low level of mortgage interest rates has been the driving force behind this discretionary borrowing caused by a confidence in the dramatic rise in home prices in many areas of the country. The low interest rates have also fueled the increase in new housing starts as well as the increased turnover rate in existing homes.

I though it was interesting to note that they are saying a substantial part of the increased turnover rate is due to purchases in the second home market. The majority of these purchases being for vacation or investment purposes. Home Mortgage Disclosure Act (HMDA) statistics show that mortgage originations for second-home purchases increased from 7 percent of total purchase originations in 2000 to twice that at the end of 2004. It is suggested that second home purchases are more speculative in nature and not limited by concerns of owner relocation. More of these homes are paid for wholly in cash. It is believed that the number of second home and investment sales is at unprecedented levels and that is what is contributing to the rise in home prices.

What does all this mean? Who knows, but to me it means --- you as a buyer may have an opportunity at this moment resulting from the perceived slowdown in speculative purchases and seller’s fear that we are at the top of the market and they are not going to realize their anticipated gains.

This article is the express opinion of Peter C. Fyler and may not be reprinted or used without his permission.

Tuesday, June 07, 2005

Welcome to SplitRock RE's MV Real Estate Insights

Thank you for visiting our weblog about Martha's Vineyard Real Estate.

A major topic these days on various people's minds here is "the bubble".

What's "the bubble"? It's the trend of rising value and price of real estate around the country. That's particularly true of Martha's Vineyard, where prices and inventory continue to rise. We saw this trend in the 1980s, and when that bubble burst, it was a canyon that the island fell deeply into.

Then again about 1999, real estate on the island seemed to double overnight, and it's continued to climb.

Many owners have placed their properties on the market looking for the high payout on their investment, and many have realized it. The question is: will this trend continue? Or will "the bubble" again burst and real estate values tumble?

That's one of the many topics we are set to discuss here. Feel free to chime in!

A major topic these days on various people's minds here is "the bubble".

What's "the bubble"? It's the trend of rising value and price of real estate around the country. That's particularly true of Martha's Vineyard, where prices and inventory continue to rise. We saw this trend in the 1980s, and when that bubble burst, it was a canyon that the island fell deeply into.

Then again about 1999, real estate on the island seemed to double overnight, and it's continued to climb.

Many owners have placed their properties on the market looking for the high payout on their investment, and many have realized it. The question is: will this trend continue? Or will "the bubble" again burst and real estate values tumble?

That's one of the many topics we are set to discuss here. Feel free to chime in!

Subscribe to:

Posts (Atom)